Aadhaar Enabled Payment System (AEPS)

In order to further speed track Financial Inclusion in the country, Two Working Group were constituted by RBI on MicroATM standards and Central Infrastructure & Connectivity for Aadhaar based financial inclusion transactions with members representing RBI, Unique Identification Authority of India, NPCI, Institute for Development and Research in Banking Technology and some special invitees representing banks and research institutions.

AEPS is a bank led model which allows online interoperable financial inclusion transaction at PoS (MicroATM) through the Business correspondent of any bank using the Aadhaar authentication.

The only inputs required for a customer to do a transaction under this scenario are:-

- IIN (Identifying the Bank to which the customer is associated)

- Aadhaar Number

- Fingerprint captured during their enrollment

How it works:

- Step 1 – Customer swaps his/her cards at Mini ATM.

- Step 2 – Mini ATM fetch data from Customers Bank

- Step 3 – Customers bank get confirmation from NPCI.

- Step 4 – NPCI get confirmations from UIDAI.

- Step 5 – UIDAI approve confirmed details about customer Account to NPCI.

- Step 6 – Again after getting confirmation from UIDAI , NPCI again asks Creditors details to his/her banks.

- Step 7- Creditors Bank Approve details of creditors to NPCI

- Step 8- NPCI now confirms to SBI

- Step 9 – SBI deduct the amount which customers want to pay/credit.

- Step 10 – Now customers get confirmations bill from Mini ATM.

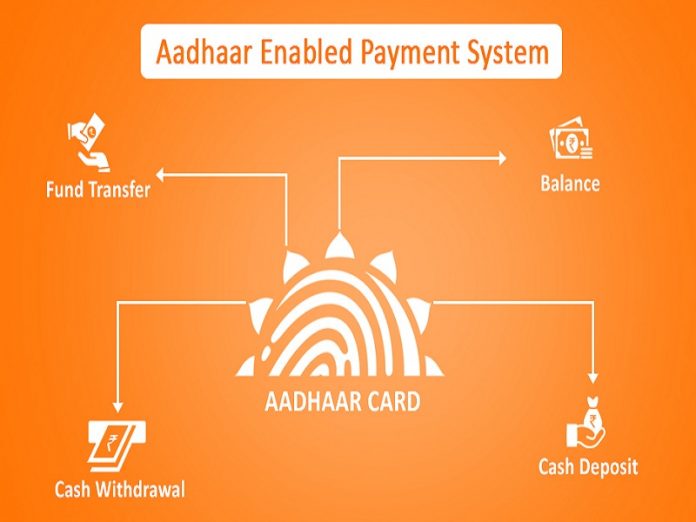

SERVICES OFFERED BY AEPS :

- Balance Enquiry

- Cash Withdrawal

- Cash Deposit

- Aadhaar to Aadhaar Fund Transfer

- Gateway Authentication Services

OBJECTIVES:

- To empower a bank customer to use Aadhaar as his/her identity to access his/ her respective Aadhaar enabled bank account and perform basic banking transactions like balance enquiry, Cash deposit, cash withdrawal, remittances that are intrabank or interbank in nature, through a Business Correspondent.

- To sub-serve the goal of Government of India (GoI) and Reserve Bank of India (RBI) in furthering Financial Inclusion.

- To sub-serve the goal of RBI in electronification of retail payments.

- To enable banks to route the Aadhaar initiated interbank transactions through a central switching and clearing agency.

- To facilitate disbursements of Government entitlements like NREGA, Social Security pension, Handicapped Old Age Pension etc. of any Central or State Government bodies, using Aadhaar and authentication thereof as supported by UIDAI.

- To facilitate inter-operability across banks in a safe and secured manner.

- To build the foundation for a full range of Aadhaar enabled Banking services.