Amalgamation, Merger, take-over, acquisition and their differences

With the Merger of Bank of Baroda, Vijaya Bank and Dena Bank, words which was being heard a lot of time was merger and amalgamation. What does these words mean and what are the differences between the given words.

Definition of Amalgamation:

If 2 or more entities are merged into a new entity with a new name, new identity then in that case that merger is known as amalgamation. For example government declared amalgamation of BOB, Vijaya Bank and Dena Bank. It would mean that all 3 banks will be merged into a new entity i.e. bank with a new name. Amalgamation is also known as consolidation.

Pros of Amalgamation:

- It actually solves the big HR issues. In amalgamation all employees are of a new entity thus any union of a particular group cannot be made.

- It creates a strong and sustainable entity

Cons of Amalgamation: In amalgamation sometimes there is an identity problem.

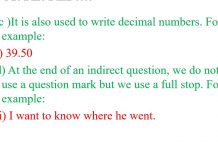

Definition of Merger:

If 1 are more entities are merged with another entity then it is called merger. For Example, State Bank of India associate banks and Bhartiya Mahila Bank were merged with State bank of India. Merger is an integration between two or more companies in order to expand their business operations and expand their reach.

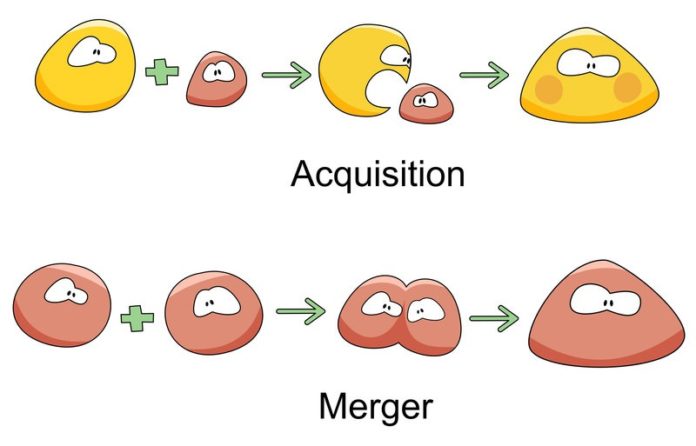

Definition of takeover / acquisition

In a acquisition or takeover a small entity is acquired by a larger company. Turnover is done in order to increase the market share of the business. Take-overs are also done in order to enter a new segment or consolidate one’s position in a segment. Like Myntra was acquired by Flipkart to enter in the apparel market. Takeover or acquisitions usually take place in private companies where 2 companies are takeover by money agreements.